In Part 3, the June installment in the series, our experts discussed updates and new developments under the Paycheck Protection Program (PPP) then answered attendee questions.

For background and a detailed discussion of the loan forgiveness applications, make sure to watch parts one and two.

A few of the topics covered include:

- Change and flexibility regarding the time-frame in which to spend loan proceeds

- Revisions to percentage guidelines regarding how to spend loan proceeds

- Changes and exceptions to headcount restoration requirements

Please note that the information presented in this video is intended for general education and was accurate, to the best of our knowledge, at the time of the presentation. Guidelines and regulations may have changes since the recording of this webinar. Before undertaking any business or financial transaction, we encourage you to consult your accounting, legal, or tax advisor.

In Part 2 of this series, we provide an update on new developments and focus on loan forgiveness under the Paycheck Protection Program (PPP). Following the presentation, our advisors answer a series of great questions from the attendees.

This webinar was recorded in May 2020. There have been many updates to the information available at that time. Make sure to view part three of this series for up to date information.

A few of the topics covered include:

- Update on selected items published in the SBA frequently asked questions

- Review of the PPP loan forgiveness application and instructions

- Discussion of recommended action items for PPP borrowers

Please note that the information presented in this video is intended for general education and was accurate, to the best of our knowledge, at the time of the presentation. Guidelines and regulations may have changes since the recording of this webinar. Before undertaking any business or financial transaction, we encourage you to consult your accounting, legal, or tax advisor.

In Part 1 of this series, we discuss the Paycheck Protection Program (PPP) and how it is intended to help businesses during COVID-19. We discuss smart management tips for effectively utilizing the funds you receive.

This webinar was recorded in early April, during the first rounds of the PPP program. There have been many updates to the information available at that time. Make sure to view parts two and three of this series for up to date information.

A few of the topics covered included:

- An overview of the Paycheck Protection Program

- What happens once you receive your PPP loan, and how to maximize your forgiveness amount

- How the PPP loan can impact your tax credits

- How you should be tracking your spending in order to maintain accurate records

Please note that the information presented in this video is intended for general education and was accurate, to the best of our knowledge, at the time of the presentation. Guidelines and regulations may have changes since the recording of this webinar. Before undertaking any business or financial transaction, we encourage you to consult your accounting, legal, or tax advisor.

Series Moderator:

Series Panelists:

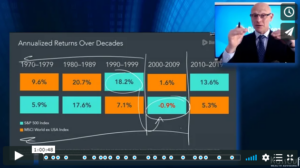

Watch On Demand: Kassouf Wealth Advisors and Dimensional Fund Advisors – Market Response to Coronavirus and Elections.

A Vice President at Dimensional Fund Advisors, Apollo is often referred to as the “Secretary of Explaining Stuff,” and it’s for good reason. With the White House and U.S. Department of State as former clients, he excels at distilling his experience and expertise into lessons we can all understand.

Kassouf Healthcare Advisory Team connects with physicians, industry leaders at Blue Cross Blue Shield’s Circle of Care

Kassouf director featured in Business Alabama magazine

Kassouf Symposium: Interns explore trending topics like AI, cryptocurrency, and blockchain in accounting